P3 launches new TCO calculator: where electric trucks already outperform diesel

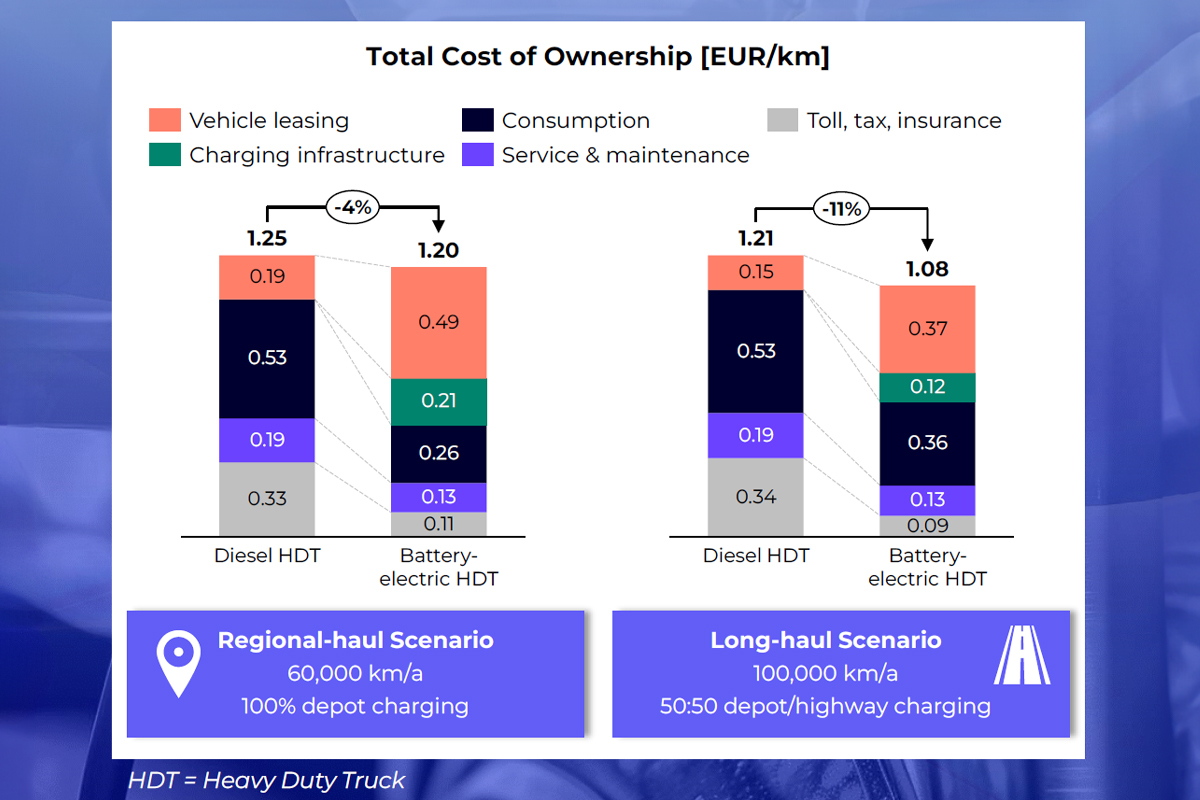

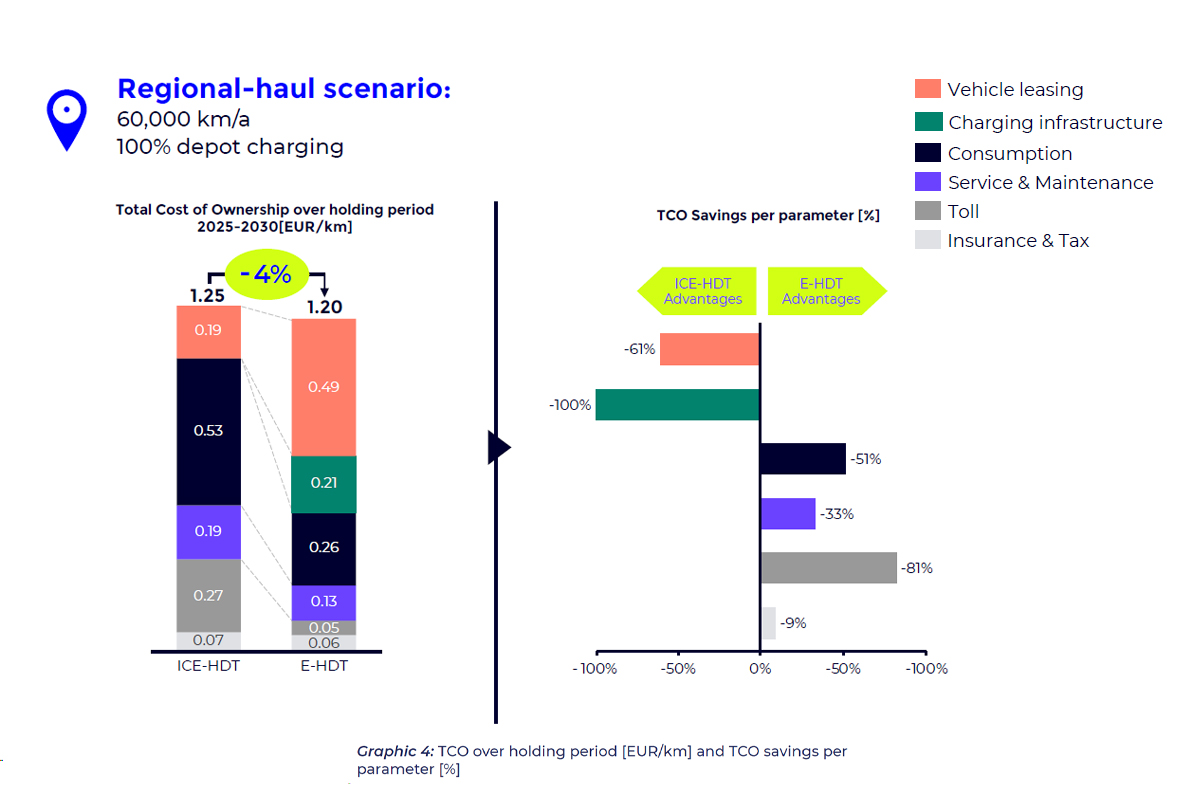

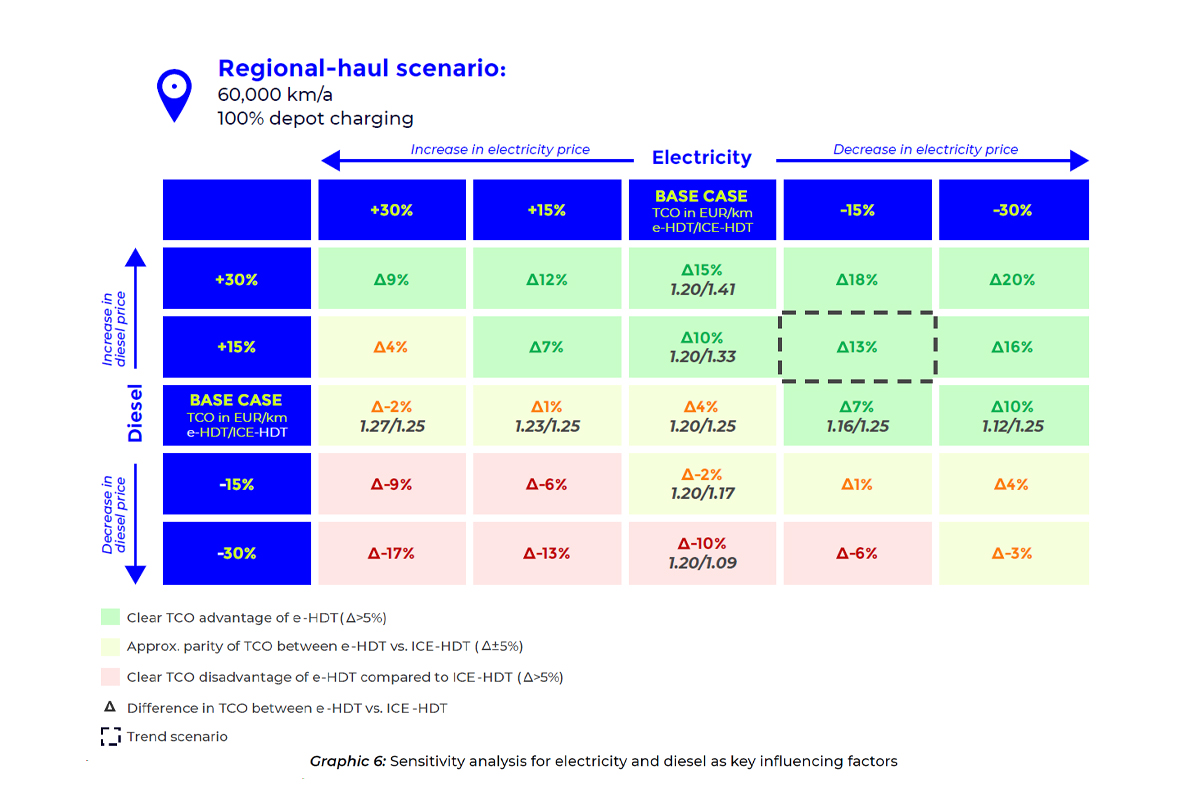

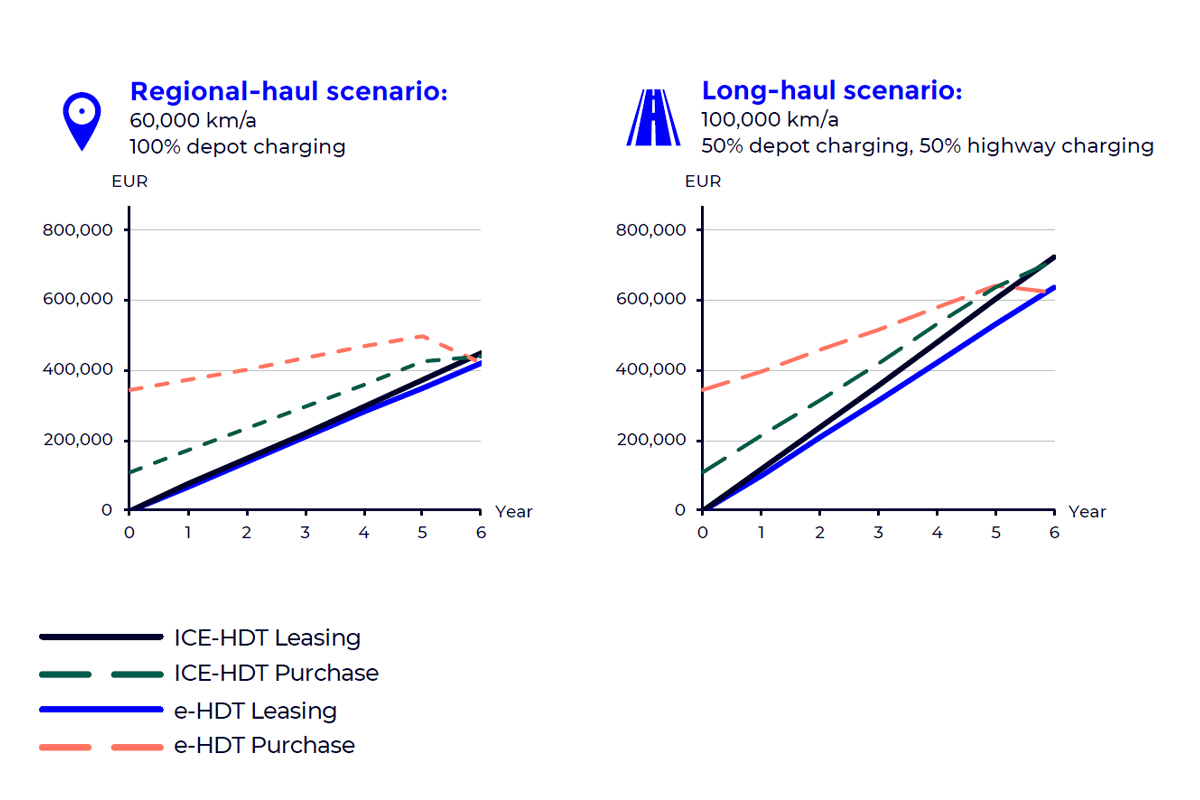

P3’s detailed comparison of the TCO between an average conventional and electric heavy goods vehicle on the German market shows – under certain conditions – cost advantages for electric trucks. In regional transport, electric trucks cost 5 cents per kilometre less than a diesel truck within a six-year operating period. The consultants’ analysts assume a daily route length of 200 to 300 kilometres, an annual mileage of 60,000 kilometres and 100 per cent depot charging.

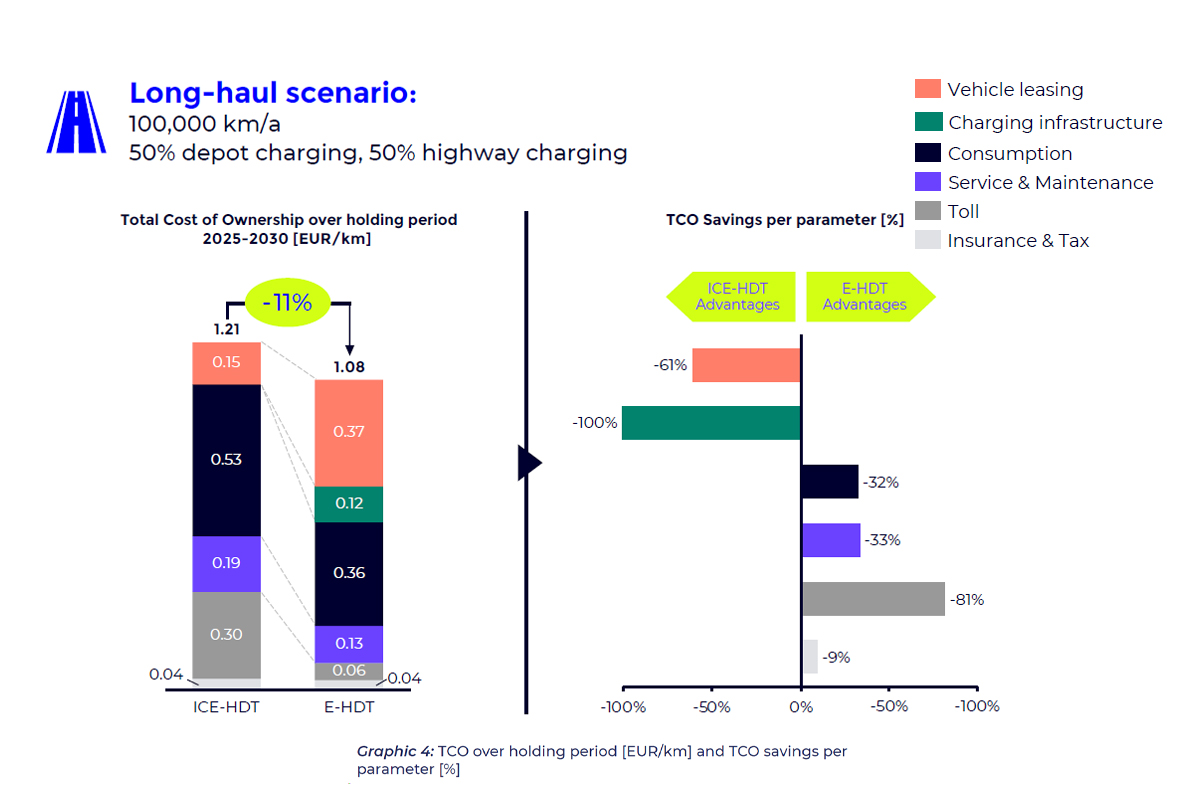

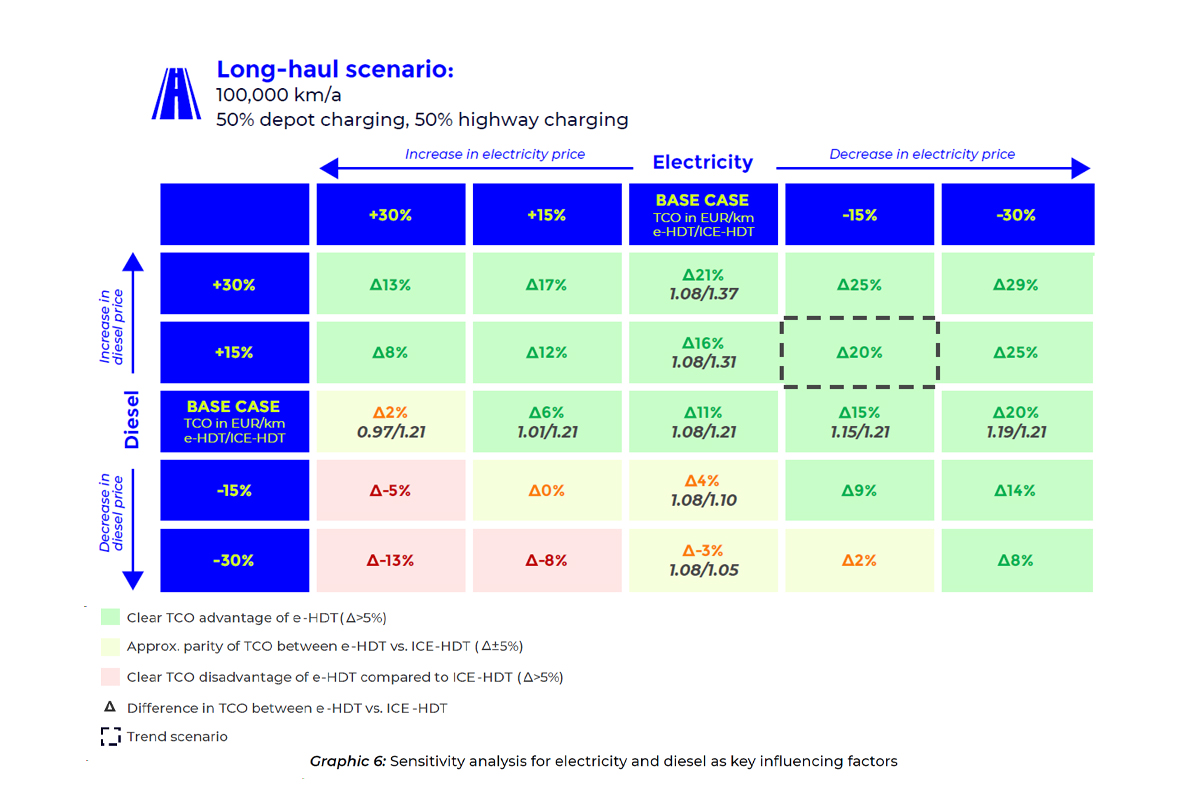

For the long-haul scenario with a daily distance of 350 to 500 kilometres, an annual mileage of 100,000 kilometres and 50:50 depot and motorway charging, the cost advantage of electric trucks over diesel trucks increases to eleven per cent, which corresponds to 13 ct/km. However, the feasibility of daily distances of around 500 kilometres is limited due to the lack of a public fast-charging network and can currently only be realised in a hub-to-hub application, the authors of the study qualify. We will come to the other limiting factors in a moment.

According to P3, the main reason for the superiority of electric trucks on long-distance routes is their higher mileage, with the break-even point (based on the underlying assumptions) being reached at 63,000 kilometres per year. In regional transport, electric trucks are ahead from an annual mileage of 52,000 kilometres. “The most significant cost advantages – lower energy cost and reduced toll rates – scale with the distance travelled, amplifying the benefits over longer routes,” according to a white paper published by P3. In addition, electric trucks benefit from lower service and repair costs and CO2 tax concessions. “These cost savings are sufficient to offset the main advantages of the ICE-HDT: lower acquisition cost for the truck and the omission of investment in depot charging infrastructure.” Depending on how the battery ages in practice, the residual value of electric trucks may vary. Of course, it could also work the other way round: that the residual value is more in favour of diesel trucks. Reliable statements on this will only be possible in the future.

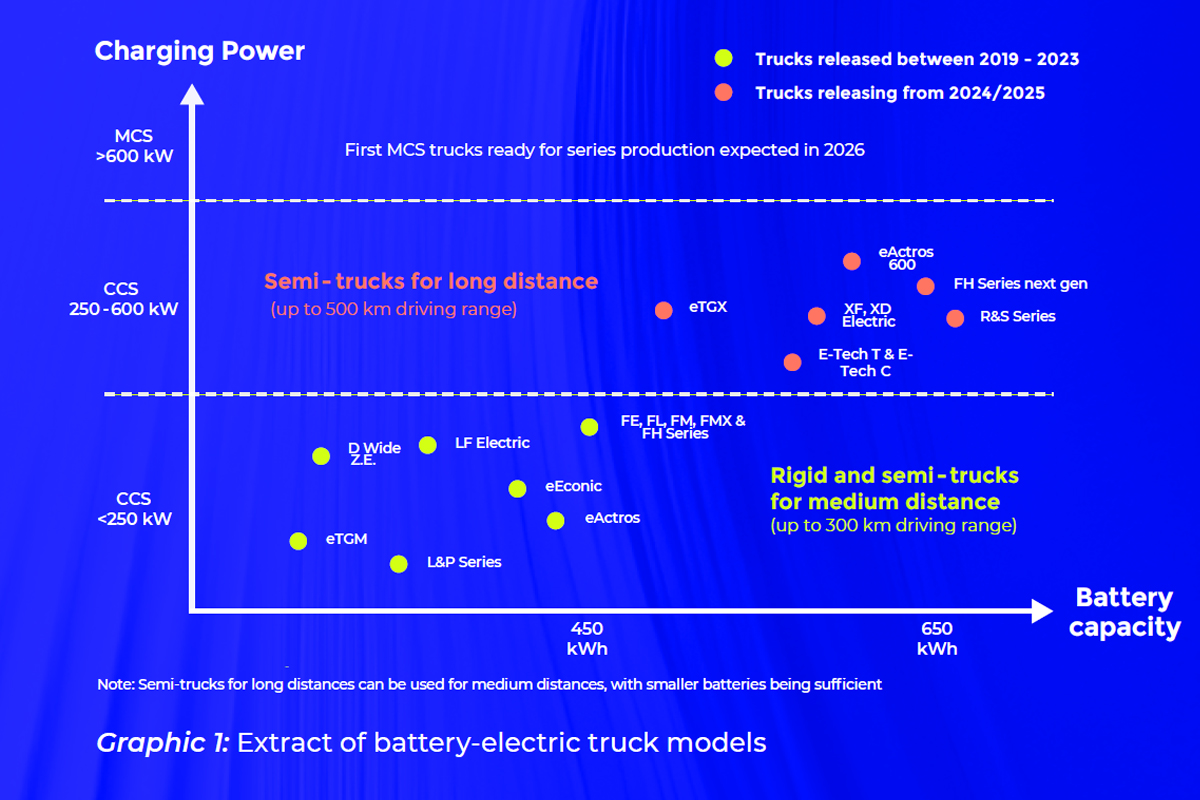

But what are the premises under which electric trucks are actually more financially lucrative than diesel trucks? First of all, from P3’s point of view, electric trucks have so far only been suitable for distances of up to 500 kilometres per day. In addition, the degree to which electric trucks are advantageous depends on low electricity costs and an appropriate grid connection for the charging infrastructure. ” If these conditions are not met, diesel lorries could remain the better choice from a cost perspective,” the analysts state, but also note that with further technological advances (“increasing battery capacities, faster charging speeds and decreasing vehicle costs with scaling of production”), the competitiveness of electric trucks will increase rapidly across a broader range of applications.

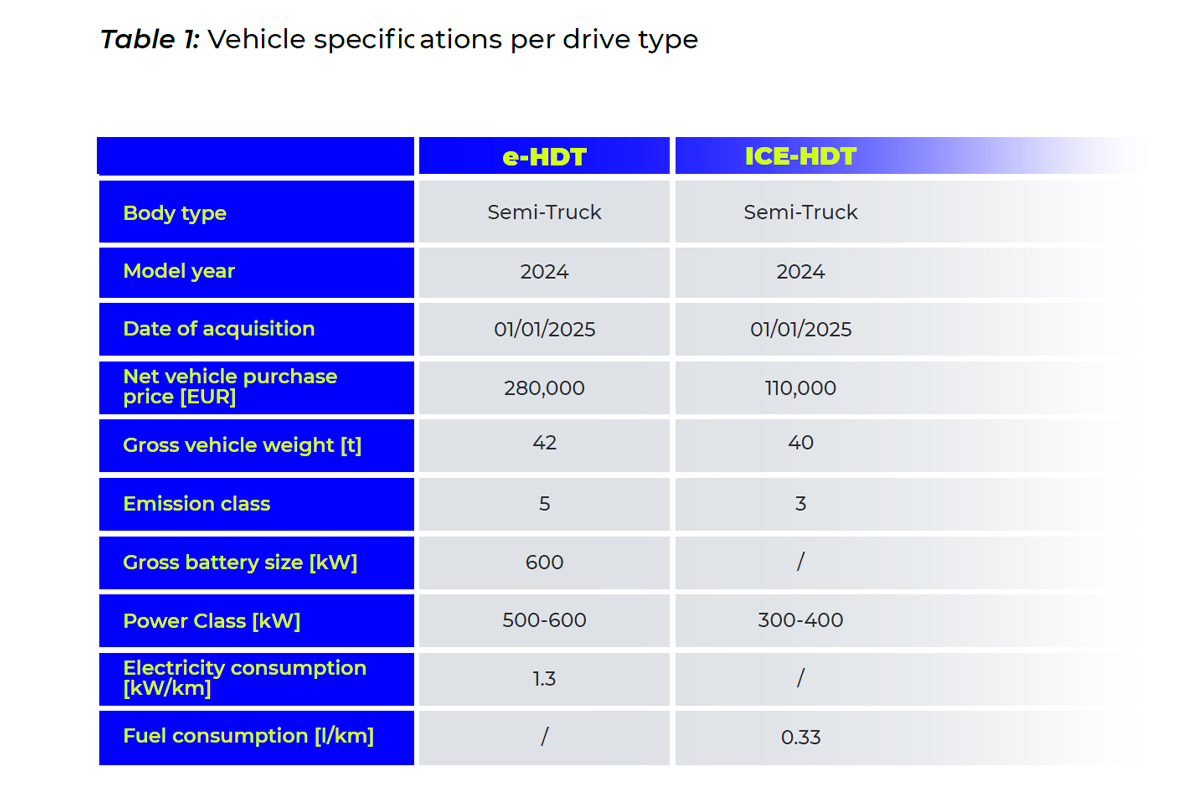

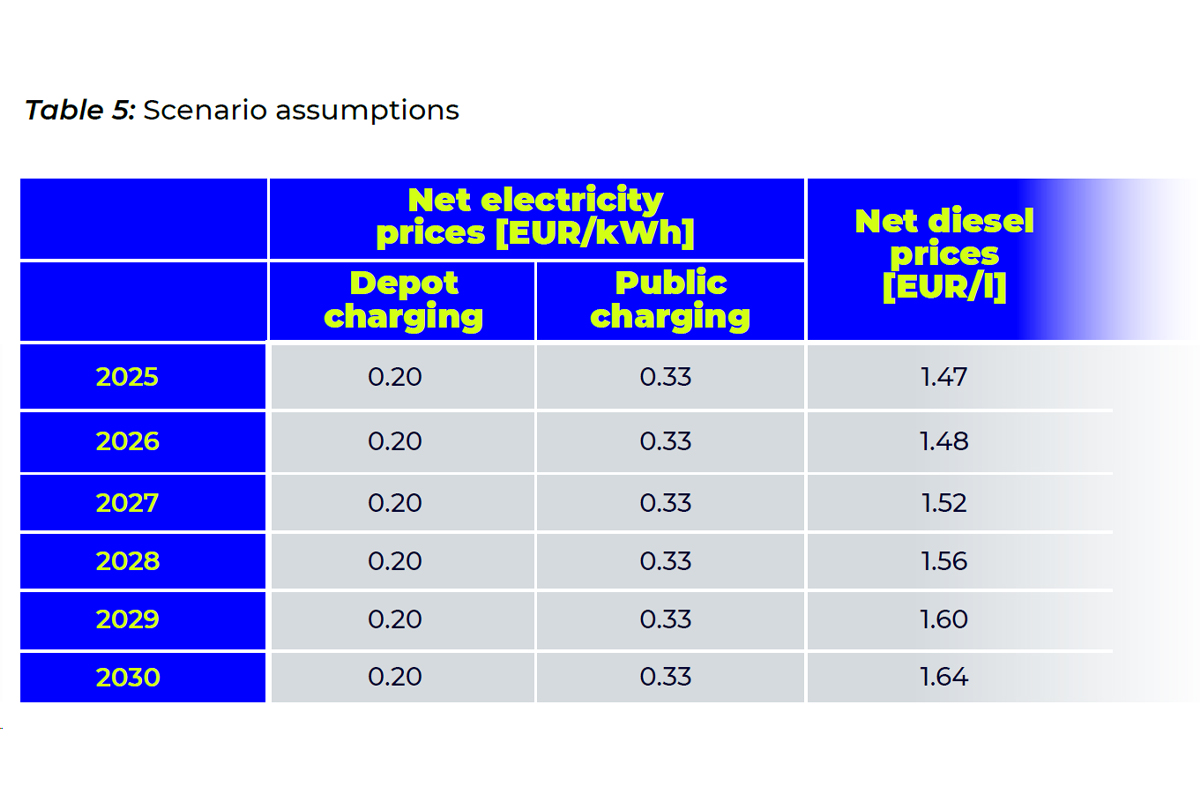

The comparison of electric and diesel trucks in Germany outlined above refers to the period from 2025 to 2030. P3 does not differentiate between different brands, referring to the technical similarity of the available models, but calculates an average truck for each of the two drive types. However, the analysts emphasise that the truck market could be shaken up by the potential market entry of the Tesla Semi, which they consider to be an electric truck that stands out from the existing range: “A highly competitive price coupled with outstanding technical performance in range and efficiency give rise to the expectation of an outstanding TCO result below 1 EUR/km,” they say. The market launch for Germany has yet to be confirmed. However, orders have already been placed in countries like Norway and the Netherlands.

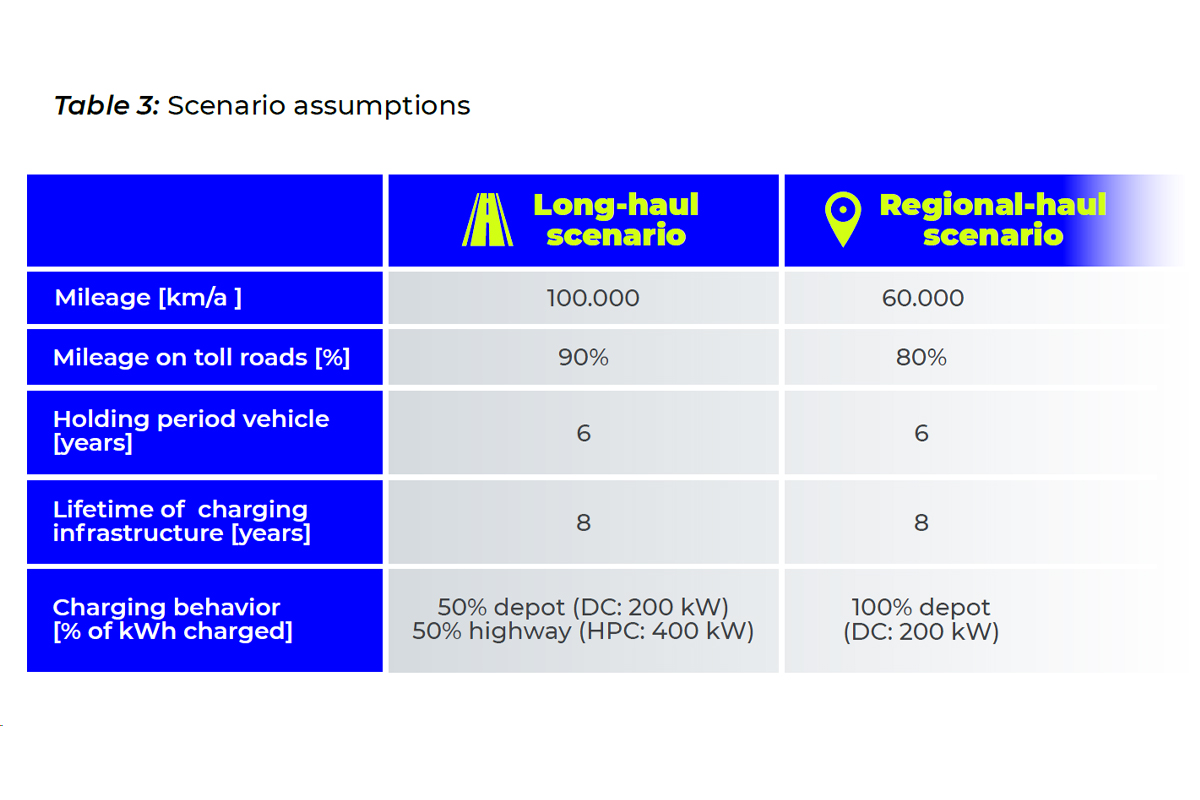

P3 provides readers of the white paper with all kinds of details on its methodology. Factors taken into account by the newly created calculation tool include fuel consumption and fuel costs, leasing costs, tolls and the cost of charging infrastructure. While P3’s TCO tool itself offers a high degree of adaptability to international markets, the white paper analysis above focuses on Germany. P3 draws on official sources (including publications from truck manufacturers and independent research organisations). On the other hand, the forecasts for energy price and cost developments are based on the consultancy’s assumptions. As a key assumption in the TCO calculation, P3 also chose leasing as the predominant form of procurement, whereby the higher acquisition costs for electric trucks are naturally reflected in a higher leasing instalment compared to diesel trucks.

What else? The costs for any battery replacement are not included in the TCO calculation (“manufacturer warranties of 6-8 years further justify this exclusion”), and the installation of 200 kW stations at the depot is assumed as the cost of the charging infrastructure. Subsidies are not included in the calculation. P3 has estimated the proportion of mileage on toll roads to be relatively high at 90 and 80 per cent for long-distance and regional transport, respectively (“due to the geographical proximity of most logistics depots to highways and main transport axes”). In addition, the analysis in the white paper focuses primarily on medium-sized and large companies with more than 50 trucks in their fleet.

Anyone wishing to customise the TCO calculator to their use case can define key assumptions in the “Configurator.” In addition to defining the truck ownership period, annual mileage and charging behaviour can be specified separately for depots and public. The consideration of subsidies and driver costs, as well as the type of acquisition (purchase/leasing), can also be selected. In addition, a model database is available that allows the input of specific manufacturers and truck models from the light to the heavy-duty segment. Vehicle-specific data (such as diesel/electricity consumption, CO2 emission class and acquisition costs) is automatically inserted for the calculation. The costs for battery replacement can also be defined, including the total mileage after which replacement is required.

According to P3, there are further customisation options for calculation factors such as inflation or interest rates for leasing, the secondary value of the battery or the pricing for diesel or electricity. This means that the tool can also be used in other international contexts.

To conclude the analysis with a focus on Germany, P3 summarises that the switch to battery-electric heavy-duty trucks will become increasingly important in the coming years in view of the TCO, even if we are currently still dealing with low absolute registration figures. According to the study’s authors, this dynamic can be attributed to “particularly high cost-sensitivity of the truck market, where operational expenses play a pivotal role in decision-making.” The market dynamics, which are strongly characterised by cost considerations and fierce competition, provide fertile ground for ground-breaking innovations that quickly gain acceptance.

According to P3, depending on the conditions at the operator’s depot, there are already use cases in which electric trucks are financially superior to their diesel counterparts. However, many fleet owners are still hesitant due to the considerable upfront investment. “To overcome this barrier, a shift towards flexible acquisition models is essential. In particular, leasing of e-HDT has gained popularity and helps to accelerate market adoption,” say the study authors. They believe alternatives such as subscription services or pay-per-use agreements could further improve accessibility.

0 Comments