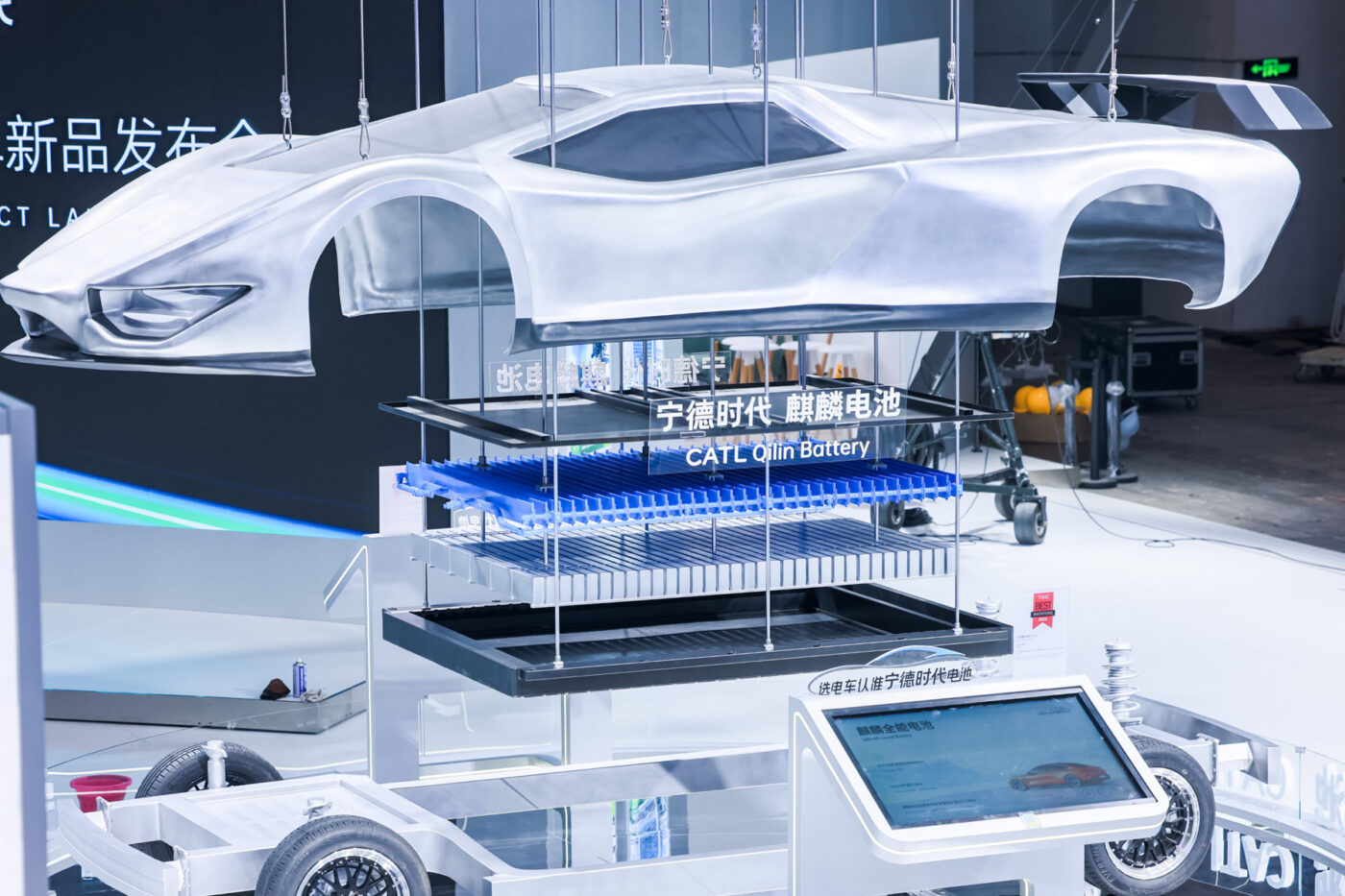

Plummeting battery prices in China may normalise EVs globally

According to a new Bloomberg report, the cost of LFP battery cells in China has fallen by 51 per cent to an average of $53/kWh since 2023. That’s remarkably lower than the average global rate in 2023 ($95/kWh). Bloomberg attributes not one but three factors to the fast-falling and significantly low battery cost in China: declining raw-material prices, overcapacity, and shrinking margins.

Raw material prices took a big hit in the last one and a half years. For instance, consider the cost of cathode, the priciest component of a battery cell. Its share in the cost of a battery cell has declined from 50 per cent in early 2023 to less than 30 per cent in 2024. The global demand for EVs does not match the number of batteries China produces, and while prominent battery suppliers are rolling out price cuts in response to overcapacity, weak players struggle with competitive shakeouts.

China’s battery plants were running at 51 per cent capacity in 2022, and then further lower at 43 per cent in 2023, and Bloomberg estimates that these manufacturing facilities will remain even more idle this year. Average prices are closing in on estimated manufacturing costs, suggesting a drop in margins. On the plus side, battery companies are improving battery technology and manufacturing processes, and these enhancements also somewhat contribute to falling prices.

BloombergNEF (BNEF), which researches commodity markets and revolutionary technologies, estimates battery prices will remain low for at least several more years. A sustained price reduction can give the world big gains in the automotive and power sectors.

Analysts have talked for years that EVs will become affordable and the new normal when battery prices fall to $100/kWh. In China, LFP battery packs now cost $75/kWh, and at that level, companies can sell EVs at the same price as or even lower than combustion engine models. Nearly two-thirds of EVs in the country are already cheaper than their ICE counterparts. The decline in battery prices in China will eventually benefit consumers in the global markets as well.

The Battery Energy Storage System (BESS) industry could benefit the most from plummeting battery prices. Turnkey deployments already cost 43% less compared to 2023. BNEF estimates a 61% increase in stationary storage installations globally this year, amounting to 155 GWh.

bloomberg.com (paywall), about.bnef.com

5 Comments