CAM study shows Germany losing position as leading European EV market

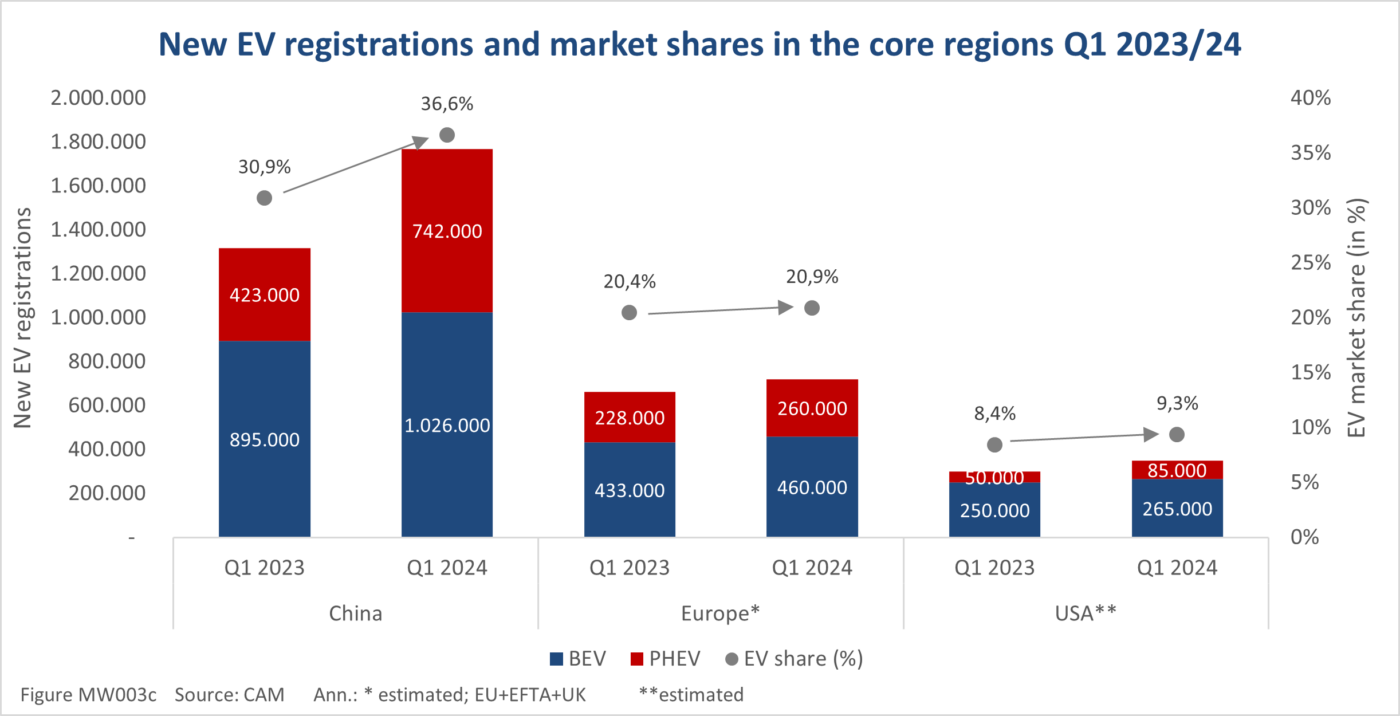

In the first quarter of 2024, a total of 1.75 million BEVs (+11 per cent) and around 1.1 million PHEVs (+52 per cent) were newly registered in China, Europe and the USA. China made the largest contribution to this with one million BEVs and 740,000 PHEVs. This means that more than every second electric car was newly registered in China. With exactly 1.026 million BEVs, China exceeded the previous year’s result of 895,000 electric cars, although growth has slowed. However, plug-in hybrids increased significantly there from 423,000 units in Q1 2023 to 742,000 vehicles – in other words, 67.5 per cent of all new PHEV registrations in Q1 came from China.

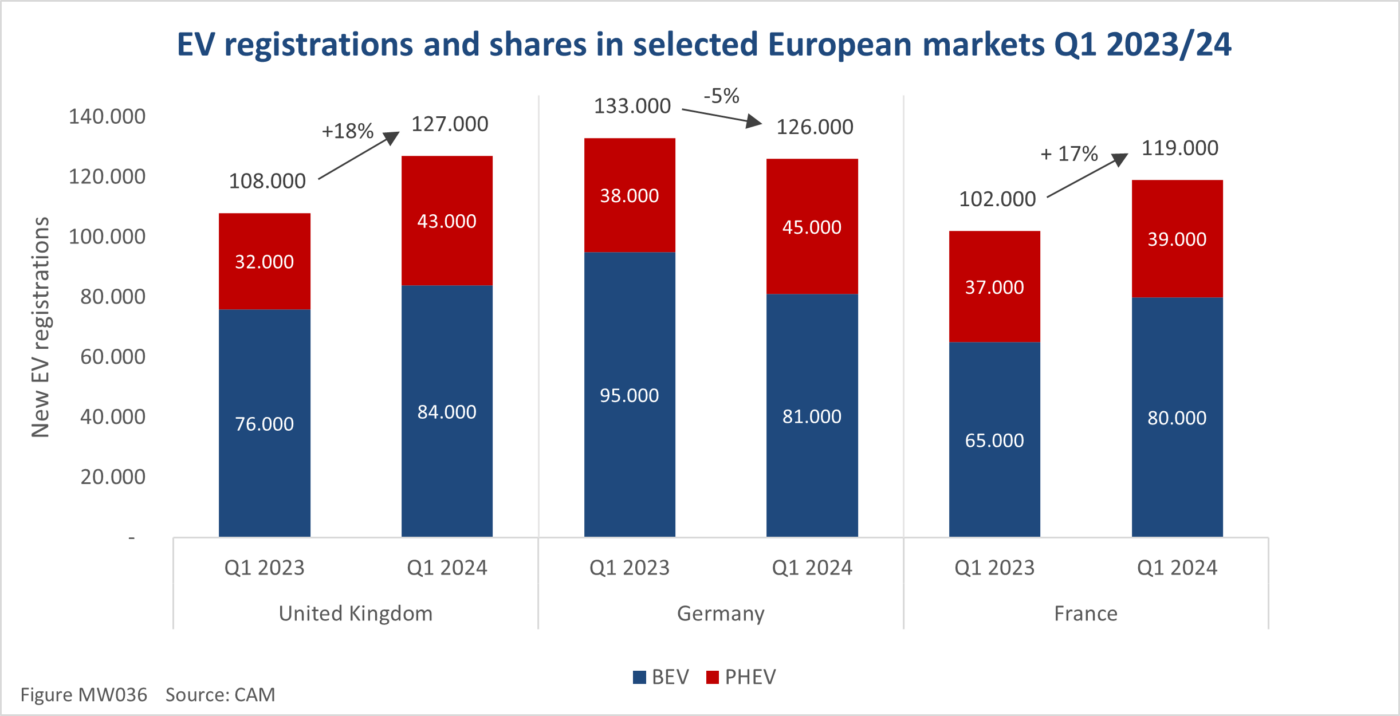

In Europe, growth has slowed even more significantly than in the Far East: BEV registrations rose from 433,000 to 460,000 vehicles over the year, while PHEV registrations rose from 228,000 units to 260,000 vehicles. One of the reasons for this is the situation in Germany, where demand was lower at the start of the year following the surprising, premature end of the purchase premium.

As a result, Germany lost its top position as the leading European electric market in terms of new registrations to the United Kingdom with 81,000 BEVs (-14 per cent). There, 84,000 new electric cars were registered in the first quarter, which corresponds to growth of eleven per cent. And Germany must be careful not to slip further into third place in terms of growth momentum in the second quarter: With 80,000 BEVs (+24 per cent), France follows only a short distance behind. “Even if PHEVs are included, the United Kingdom is just ahead of Germany with 127,000 new registrations and France with 119,000 EVs,” says the CAM.

A look at North America is still missing: BEV and PHEV registrations there have also only increased slightly. Fully electric passenger cars totalled 265,000 units (Q1 2023: 250,000 vehicles), while part-time electric vehicles increased from 50,000 to 85,000 registrations. Overall, the estimated EV quota in the USA is 9.3 per cent, compared to 20.9 per cent of all new registrations in Europe. China still made the biggest leap from 30.9 per cent in the previous year to 36.6 per cent.

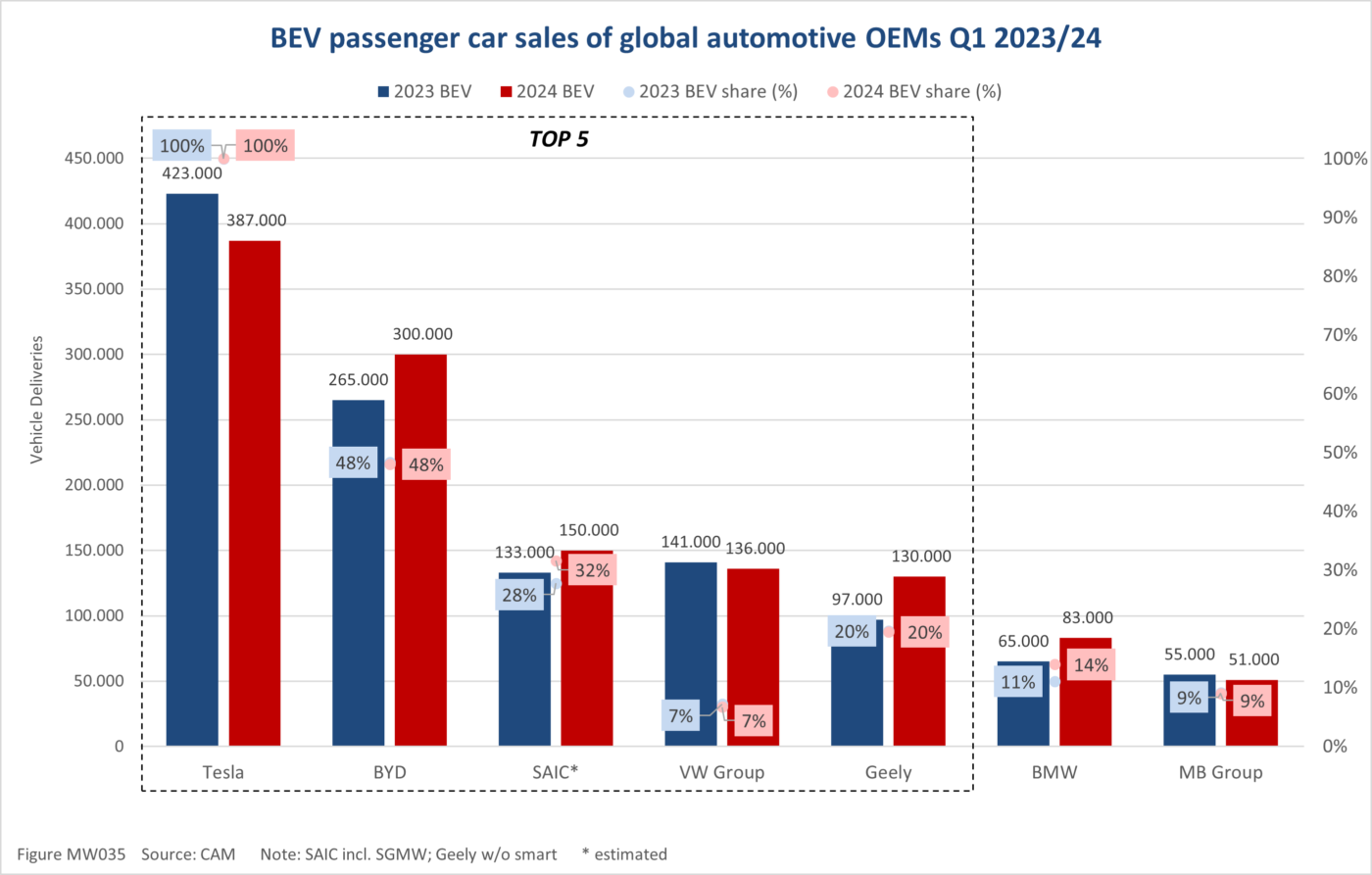

Of course, this growth dynamic also has consequences for the manufacturers’ figures, which are already known from their individual publications: BEV market leader Tesla records a reduced sales volume of 387,000 cars (-9 per cent) and even BYD only reports an increase of 13 per cent to 300,000 BEVs despite significant price reductions. Among the German manufacturers, BMW (+28 per cent) recorded the strongest growth. Instead, the VW Group (-1 per cent) and Mercedes-Benz (-7 per cent) suffered a drop in volume. “For the full year 2024, the Center of Automotive Management (CAM) expects around 10 million BEVs (+11 per cent) due to the tense situation, including almost 6 million in China, 2.3 million in Europe and around 1.3 million in the USA,” the press release states.

While the top two places in the manufacturer ranking remain unchanged with Tesla and BYD, there is likely to have been a change behind them: VW, with its slightly declining e-sales of 136,000 units, is now only listed in 4th place by the CAM. The reason for this is SAIC, which itself reported sales of 210,000 new energy vehicles (BEV, PHEV and FCEV). The CAM estimates that 150,000 of these units are battery electric cars, which means that SAIC is ahead of its joint venture partner from Germany after 133,000 units in the previous year. According to the CAM, the still low electric share of seven per cent at the VW Group is a cause for concern. In comparison: Tesla’s share is logically 100 per cent, BYD’s is 48 per cent, SAIC’s is an estimated 32 per cent and Geely in fifth place with 130,000 BEVs also has an electric share of 20 per cent.

The CAM also refers to the regional differences in development and is not just referring to Germany. In the USA, Tesla is still the dominant manufacturer, but the Tesla share of all new registrations has fallen from 62 to 55 per cent within a year. In addition, plug-in hybrids are also increasingly being seen as an alternative to fully electric drive systems in the USA. Some manufacturers, including the domestic groups Ford and GM, have revised their BEV plans backwards in favour of PHEVs – even if hybrids are currently only achieving a manageable level of registrations.

“The ramp-up of fully electric passenger cars is in a critical transition phase and is stalling in many parts of the world in favour of combustion and hybrid technologies (e.g. PHEVs). In view of the omnipresent climate threat and the political discussion about postponing emission targets, this development can be classified as alarming,” says Stefan Bratzel, head of the study. “What we need now is a revitalisation of the markets with technologically mature and attractively priced models. This is the only way to convince difficult groups of buyers without an early-adopter mindset in the long term. These already exist and are increasingly coming from Chinese factories, which should give the local industry pause for thought.”

0 Comments