CAM statistic shows Europe’s EV market grew by 45%, China’s by 19%

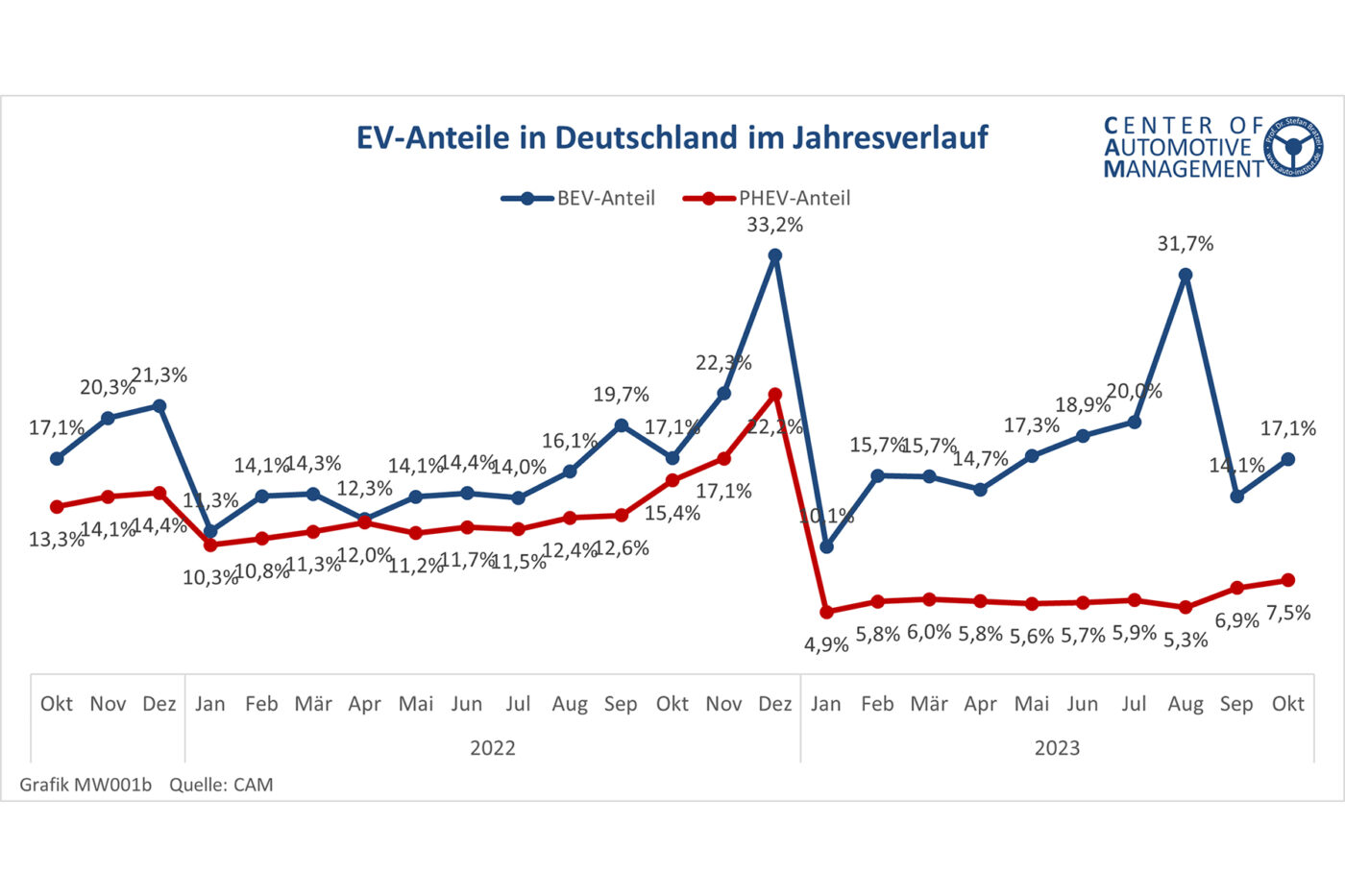

In its latest report, the German CAM looks at the sales trends for e-mobility in 2023 in an international comparison. According to the Center’s evaluations, around 425,000 BEVs (+38%) and 140,000 PHEVs (-44%) were newly registered in Germany after ten months. This means that Germany accounts for more than a quarter (26%) of new BEV registrations and just under a fifth (17%) of new PHEV registrations in Europe. In the analysis, “Europe” includes the EU member states plus Iceland, Liechtenstein, Norway, Switzerland and the UK.

Together, BEV sales in Europe between January and October 2023 amounted to 1.63 million passenger cars, an increase of 45% compared to the same period last year. Internationally, however, China remains by far the largest market for e-cars. Just over 4 million BEVs (+19%) were sold there after ten months, which corresponds to a global market share of 23%. It is also interesting to note that plug-in hybrids are becoming increasingly important in China. In the first ten months, PHEV sales grew by 83% to almost 2 million units. It is well known that there is a strong trend in China towards so-called EREVs, i.e. electric vehicles with range extenders, which fall under plug-in hybrids.

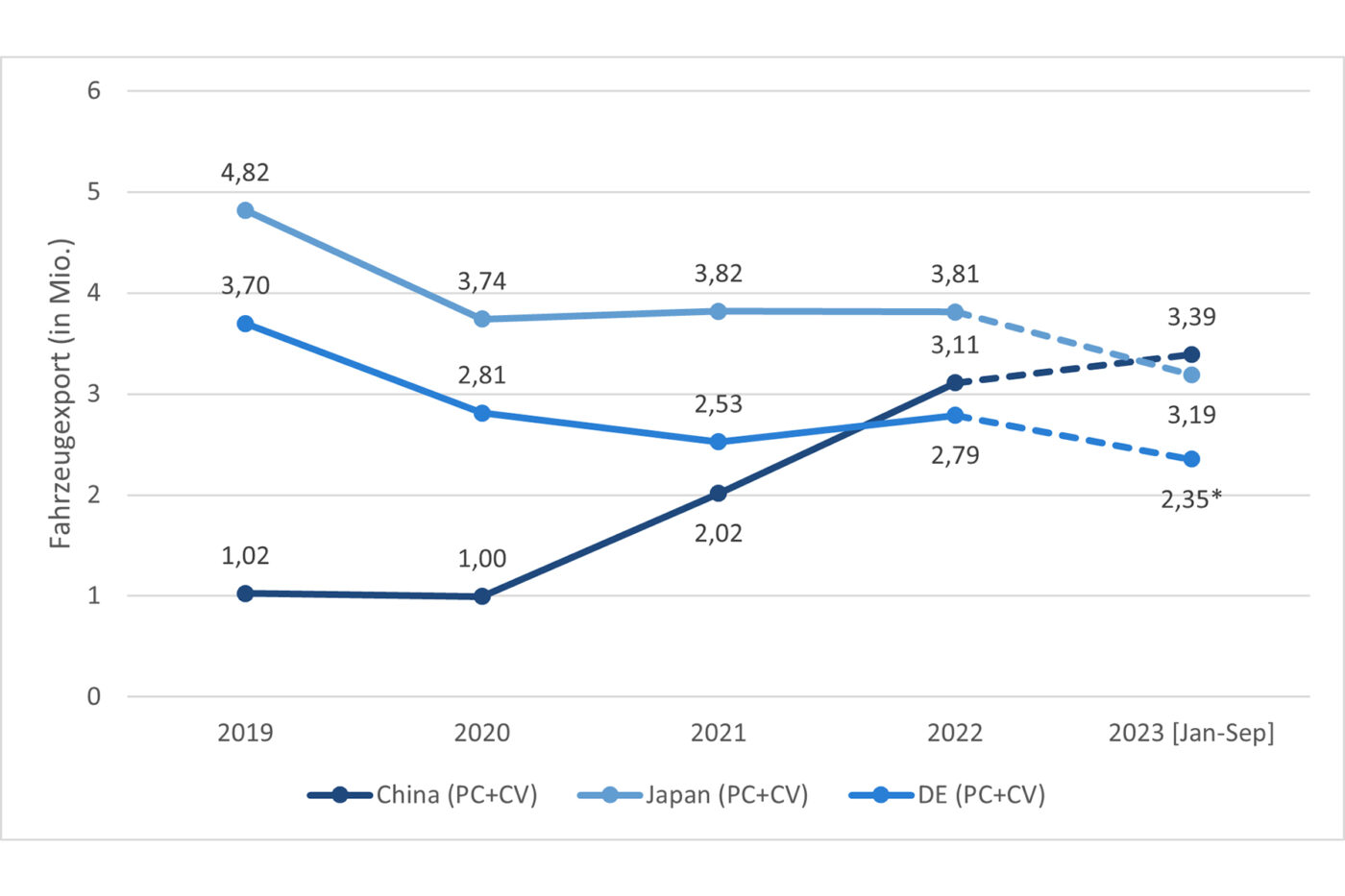

According to the CAM, vehicles with plugs now account for more than a third (35%) of new car registrations in China. From January to October 2022, this figure was still 26.5%. The People’s Republic is also becoming increasingly important for vehicle exports: by September 2023, around 3.4 million vehicles (+60%) had been sold overseas this year, including 825,000 BEVs and PHEVs (+110%).

This makes China the world export champion for the first time, overtaking Japan after Germany last year. The latter two nations exported 2.4 million (Germany) and 3.2 million (Japan) vehicles between January and September. China’s largest exporters are SAIC and Chery with 761,000 and 648,000 vehicles respectively, followed by Tesla (265,000), Changan (261,000) and Geely (247,000).

The CAM does not include the American continent in its new report. Meanwhile, there are further findings on Europe in addition to the 1.63 million new BEV registrations (+45%) between January and October mentioned above. For example, electric vehicles now have a market share of 15.2% in Europe. A year earlier, this figure was 12.2%. In addition to Germany (425,000 BEVs), the United Kingdom (262,000) and France (230,000) in particular have high BEV sales, although their market shares of 16.3% and 16.0% respectively are still lower than in Germany (18.0%). By contrast, the relative prevalence of fully electric vehicles is high in Sweden (38.6%), Finland (33.5%), the Netherlands (29.5%) and the pioneering country of Norway (83.5%). In Spain (5.0%) and Italy (3.9%), on the other hand, BEVs have only achieved low market penetration to date.

In addition to the sales figures for Germany for the first ten months (425,000 BEVs and 140,000 PHEVs), the CAM report specifies that battery electric vehicles, with their 18% growth, continue to outperform the overall market (+13.5% to 2,357,025 new registrations) despite the reduced subsidy framework. However, the end of the purchase incentive for commercial registrations was certainly reflected in weaker sales in September and October and could still significantly depress the annual statistics: For the year as a whole, the CAM only expects pure electric vehicles to grow by 8.5% to 510,000 compared to the previous year (2022: 470,559).

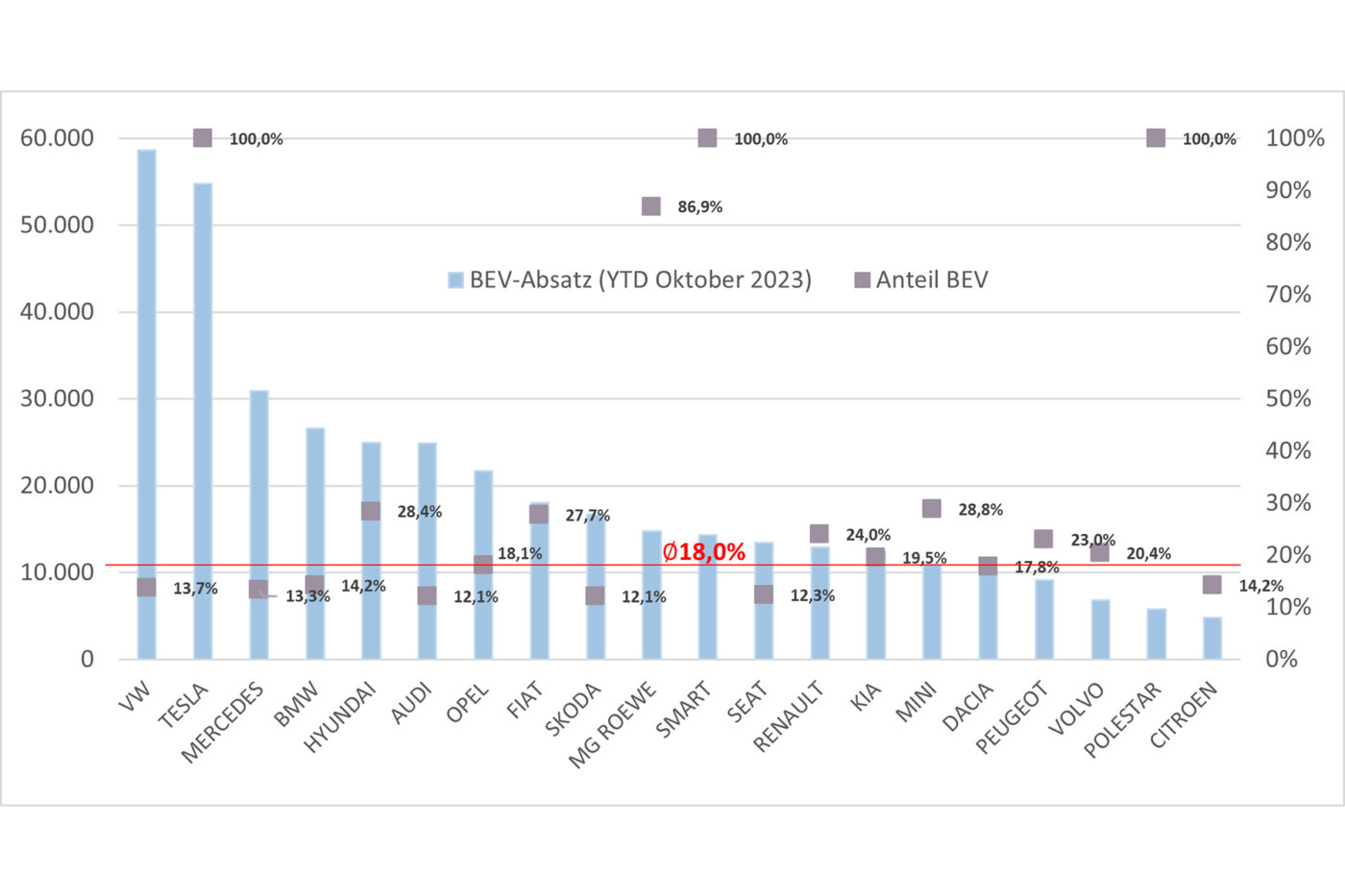

The market leader among all-electric vehicles in Germany so far this year is the VW brand with 58,661 new registrations, closely followed by Tesla (54,761). Mercedes, BMW, Hyundai and Audi are well behind in 3rd to 6th place, with Opel, Fiat, Skoda and MG Roewe also making it into the top 10 of new BEV registrations. As a subsidiary of the SAIC Group, MG is the first Chinese brand to make it into the top 10 of the German BEV new registration statistics.

According to CAM, in addition to the pure electric brands Tesla, Smart and Chinese electric brands such as Polestar, Great Wall Motors, BYD and Nio, some manufacturers have achieved significantly above-average BEV shares of new registrations so far this year. In Germany, this applies to MG with almost 87%, Hyundai, Fiat and Mini with around 28% and Renault, Peugeot and Volvo with over 20%. In contrast, the BEV shares of BMW (14.2%), VW (13.7%), Mercedes (13.3%) and Audi (12.1%) are below average compared to the market. For manufacturers such as Honda (5.3%), Toyota (4.8%) and Ford (3.5%), purely electric vehicles still play almost no role in vehicle sales in Germany.

“While electromobility continues to grow at a high level in China, the momentum in Germany is weakening and is in a critical transition phase,” summarizes study director Stefan Bratzel. Higher interest rates and decreasing subsidies are leading to higher leasing and financing rates for electric vehicles, which are already more expensive, and are likely to slow down market momentum. “In addition, the generally high-earning, tech-savvy early adopters have been catered for and the lower market segments and buyer groups with significantly smaller budgets increasingly need to be addressed.”

Bratzel therefore believes that more electric models below the mid-range, with purchase prices on a par with combustion engines, are needed in the near future in order to continue the market ramp-up. For European car manufacturers, reducing manufacturing costs is the biggest challenge in order to survive the price war against competitors such as Tesla and some Chinese manufacturers.

Source: Info via email

0 Comments