CAM study finds PHEV sales rose in Europe over Q1

An analysis by the Center of Automotive Management (CAM) found that new registrations of BEVs and PHEVs increased strongly in Europe and China in the first quarter of 2021. China remains the largest electric market, just ahead of Europe. What is striking is the enormous increase in new PHEV registrations in Europe.

The analysis sent to our editors by email is entitled “E-Mobility: Market Trends in the Core Regions Europe and China in the 1st Quarter 2021” and looks at the two regions that are said to have the highest dynamics in the electric car and plug-in hybrid market. Study director Stefan Bratzel confirms this assumption: “China and Europe are currently the drivers of electromobility.” Within Europe, Germany is increasingly taking on a pacemaker function for electromobility.

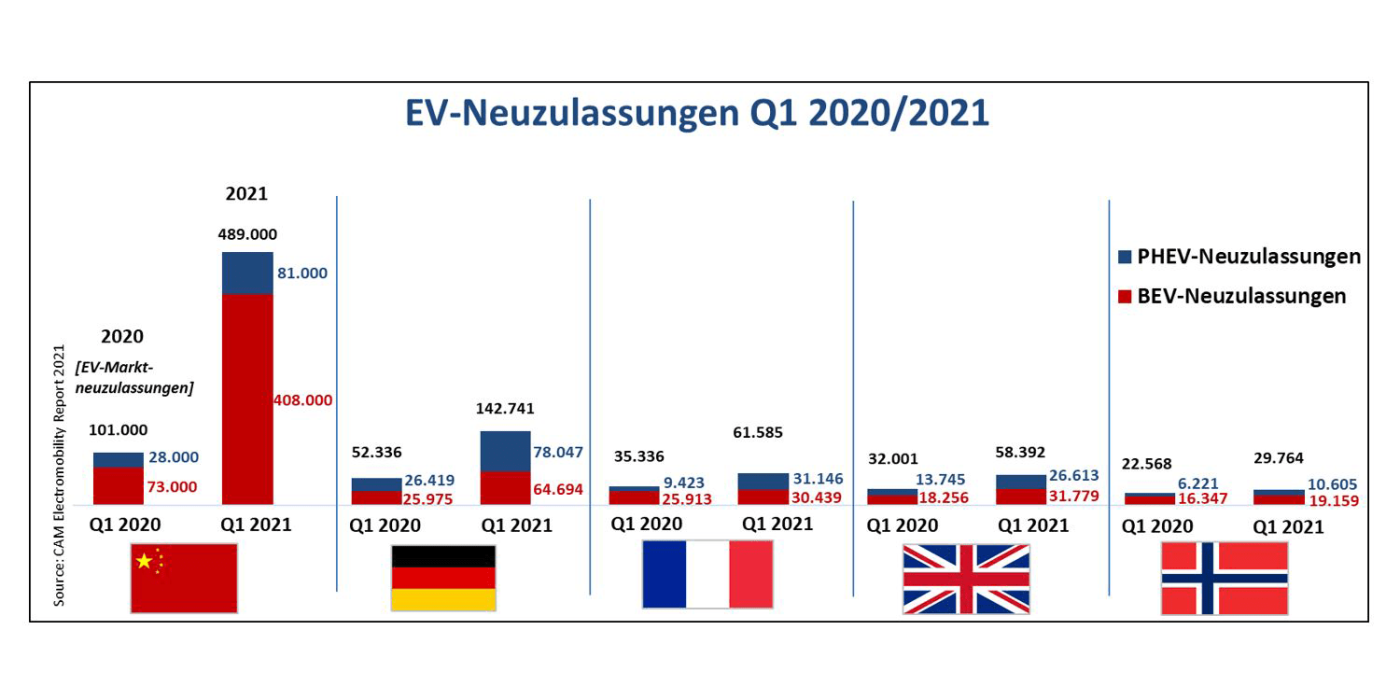

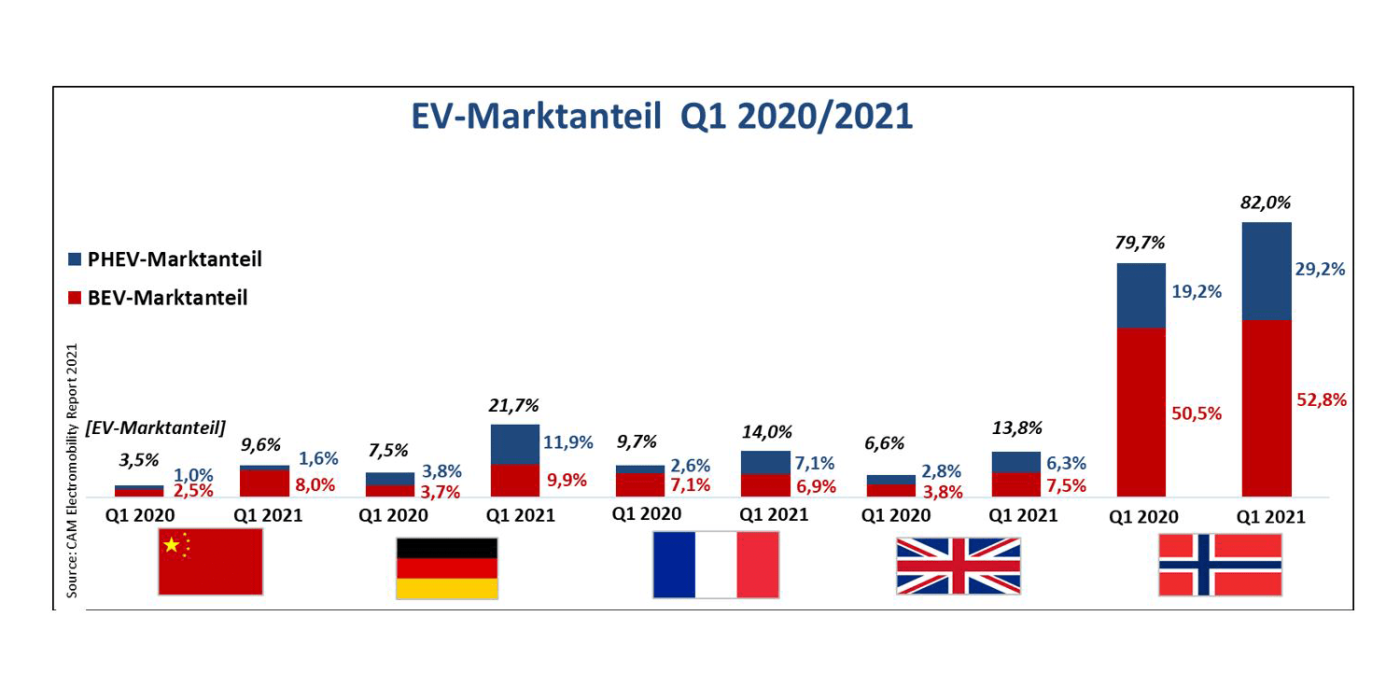

But let’s take it one step at a time: In China, 489,000 electric vehicles were newly registered in the first quarter of the year, including 408,000 BEVs and 81,000 PHEVs. This represents almost a fivefold increase in EV registrations compared to the Corona-dominated same period last year. The share of electric vehicles in new registrations rose from 3.5 to 9.6 per cent in Q1.

In Europe (defined as the EU and EFTA countries plus the UK), new registrations in Q1 totalled 452,901 electric vehicles, including 202,410 purely electric vehicles and 250,491 plug-in hybrids. Compared to the same period last year, this means an increase of 54.6 per cent for BEVs and 153.5 per cent for PHEVs. While battery-electric vehicles dominate the eMobility market growth in China, plug-in hybrids are also responsible for the high dynamics in Europe.

This is also reflected in the most important European e-mobility markets: Germany remains the second-largest single e-mobility market in a global comparison in the first three months of the year, with sales of PHEVs tripling to around 78,000 vehicles compared to the same period last year. Plug-in hybrids accounted for 11.9 per cent of new registrations in Q1. In addition, the study records 64,694 newly registered battery electric vehicles, bringing the BEV new registration share to 9.9 per cent. The statistics thus reveal that one in five newly registered vehicles in Germany between January and March was electrified (21.7 per cent).

France represents the second largest electric vehicle market in Europe with 61,585 new registrations in Q1. For the first time, more plug-in hybrids than battery-electric vehicles were registered there in the first three months. With a growth rate of around 230 per cent, France shows the strongest dynamics in the markets considered, the CAM reports. In absolute numbers, 31,146 PHEVs and 30,439 BEVs are newly on the roads in France.

Striking growth figures in the plug-in hybrid segment can also be observed in Great Britain and Norway. In the UK, the number of newly registered PHEVs doubles from 13,745 in Q1 2020 to 26,613 PHEVs in Q1 2021, with a total of around 58,000 electric vehicles (BEV+PHEV) added in the UK between January and March. In Norway, BEVs continue to dominate, with their share of new registrations increasing only slightly to 52.8 per cent. PHEVs, on the other hand, increased their share of new registrations in Norway by around 10 percentage points to 29.2 per cent. This means that e-vehicles already account for 82 per cent of all new registrations in Norway.

So at the beginning of the year, China remains well ahead of Europe in terms of battery-electric vehicles. Domestic manufacturers are also contributing to this with their models. The Wuling Hong Guang Mini EV, the sprossling of the General Motors Chinese joint venture with SAIC and Wuling, recently presented at the Shanghai Auto Show in a convertible version and soon to come to Europe, achieved 100,000 new registrations in the first quarter, followed by the Tesla Model 3 (a good 50,000 new registrations) and the BYD Han EV (a good 20,000 new registrations).

Stefan Bratzel, head of the study, describes the strongly increasing share of plug-in hybrids in electric vehicle registrations in Germany and Europe as “not uncritical”. They are favoured above all by the subsidies. “Since plug-in hybrids are often not regularly charged, the real CO2 emissions are often many times higher than the standard values. Politicians and car manufacturers are called upon to remedy this situation.” For the market ramp-up of purely electric vehicles, the density and reliability of the charging infrastructure remains the greatest challenge.

The Center of Automotive Management (CAM), based in Bergisch Gladbach, regularly analyses the international e-mobility market. The institute not only focuses on country comparisons but also measures the innovative strength of car manufacturers, among other things. Our other reports on evaluations by the Center of Automotive Management can be found here.

With reporting by Cora Werwitzke, France.

Source: Press release via email

0 Comments