Torqeedo execs Plieninger, Rummel & Goethe lift next challenges for e-mobility on water

With everybody stuck at home, it pays to look to the wide-open waters. Or to the smaller blues of Lake Starnberg that is home base to Torqeedo. 15 years in the game, the small enterprise has become the market leader in e-mobility on water, and we wanted to discover what’s next.

* * *

Our report, to our dismay, took not place on a boat but in various home offices. The interview turned out a virtual round table as it gathered Torqeedo’s Managing Directors Dr Ralf Plieninger and Dr Michael Rummel as well as Director of Product Management, Phillip Goethe. The managers had just recorded Torqeedo’s 2021 product launch, and we took the chance to dive a little deeper.

A few words on what being a market leader for e-mobility on water means. Torqeedo looks back at 100,000 e-drives built and average annual growth of 30 per cent since coming out in 2005. Since then, management has changed, not the least because Deutz took over in 2017. The company rooted in combustion engines has been slowly electrifying its portfolio by taking on pioneering businesses and made Torqeedo part of its e-Deutz strategy.

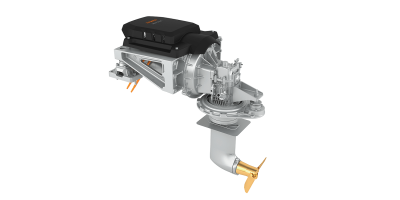

The same is true for Futavis, which Deutz bought last year for the battery expertise. The SME specialises in the high-voltage segment and helps Torqeedo build the battery management system, now also for their stronger lines, namely Deep Blue. Started in 2013, it is “still the only high-voltage system in marine applications,” explained Dr Plieninger, Torqeedo’s Managing Director for technology.

In the latest iteration, Deep Blue delivers propulsion at up to 100 kW. In 2021, a new version developed together with ZF for primary sailors will push for speeds of up to 30 knots or about 15 kph. Dr Plieninger in the interview with electrive commented on the cooperation mostly in terms of volume and ZF’s expertise on board.

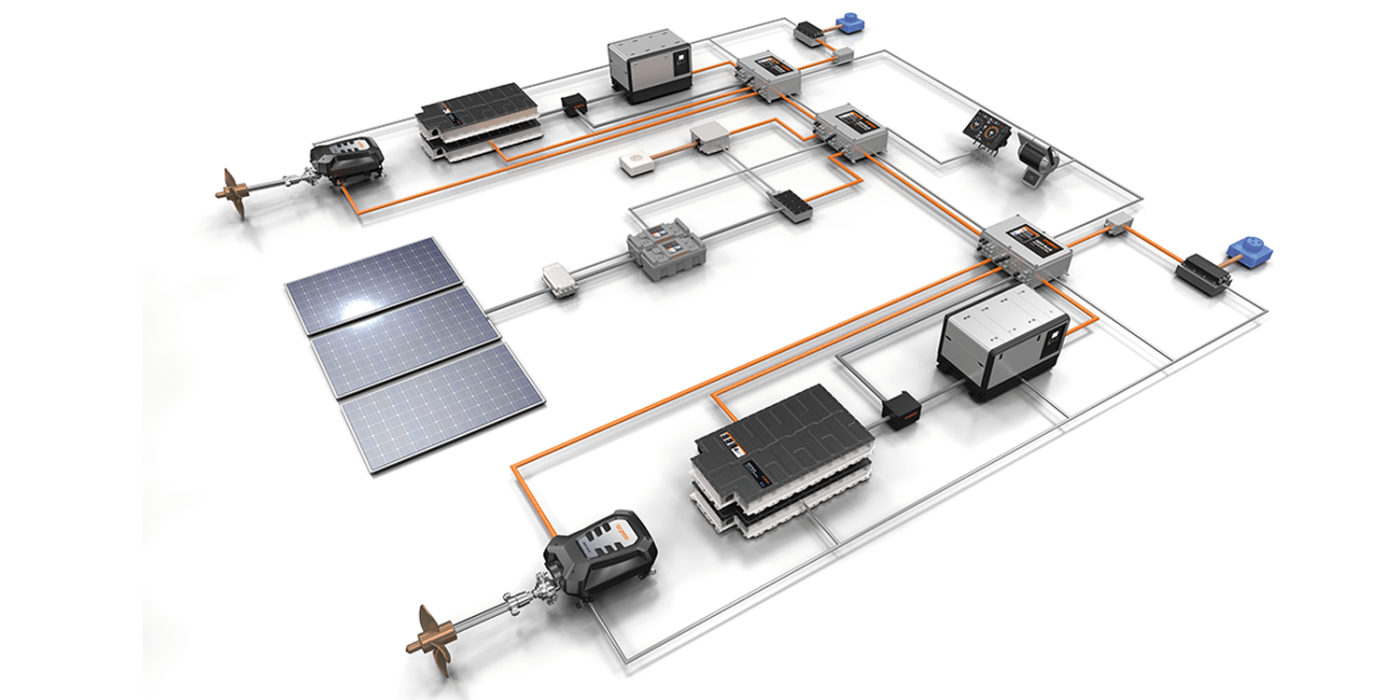

Powerful partners are essential for Torqeedo. The company prides in offering the full system from one hand. Solutions like the newly extended TorqLink enable components to communicate and work together, be it battery, motor or energy sources such as solar panels.

At the same time, they rely on suppliers for all their components. Again Dr Plieninger: “What we do historically is that all the parts we use in all products, we source externally. What we do in-house are the design and final assembly and quality testing.”

A crucial component for their drives is the battery, and Torqeedo has relied on BMW technology from the i3 “from day one,” Dr Plieninger knows. When asked whether they fear the supply drying up, we got a clear no from the Managing Director, “also due to the fact that compared to the volume they run on the very same line for the automotive production, we are a small player”. That does not mean they would not look for around for suppliers, especially for new products, he later added.

At the same time, Torqeedo is covering all segments with its existing lines. These are modular, and the company has stressed repeatedly, that they work application based. This means, they electrify not all marine segments (yet) but specialise in those areas that are ripe to run on zero emissions.

The classic Torqeedo use case has been the recreational market, starting at pleasure crafts and moving into increasingly larger yachting waters.

They have reached market leadership in the segment and were “ready to face the music,” as Dr Michael Rummel, the Managing Director with a focus on finances, puts the company’s approach to the rising competition.

He estimates the electric boat market to reach a volume of eight billion dollars in 2024. This would leave “enough space for us,” he says but continues to mention “positive challenges” such as new (unnamed) competitors, which he considers “fast followers” in the recreation segment.

Torqeedo’s answer will be innovation spurred by profitability that Dr Rummel sees the company achieving by the end of next year. Revenue stood at €34 million last, and the aim is to turn over 100 million euros in 2024.

Commercial is the next big thing

That turnover is three times as much as today, and the executive gave an outlook on how the company wants to deepen its sales channels. “We are heading towards the so-called commercial or project segments with professional customers.” These are clients who run boats for commercial purposes, something that Torqeedo considers eco-charter. On a bigger scale, these segments count public transport projects like ferries, water taxis or even shared fleets on water.

Dr Rummel points to existing projects in Thailand and also mentions plans to enter China and first steps that they have taken in Japan. EMEA and Asia remain priorities with the USA being potentially next.

Here Torqeedo is also going new ways with what Phillip Goethe calls Application Engineering, where they work with partners to adapt their solutions. The Director of Product Management points out the importance of such close cooperation projects. After all, Torqeedo provides drives not boats, so “boat builders are key to the high voltage range,” says Goethe.

There shows another uniqueness of the boat market. Most ships are custom-built and down to purpose. Sometimes this is just the one home lake or simply the budget, which can be substantial. “So a custom-build boat always requires to understand the customer and their use case,” the product manager explains. Torqeedo solution sometimes encompasses hydraulics and a prominent example of more unusual cooperation is the Swedish foil boat Candela that Torqeedo helped launch.

The Product Manager also stresses that they can adapt to various applications, by changing the rpm of the propeller, for example, from recreational (fast) to commercial (strong and steady). The company also recently “received the DNV GL certification for our battery or modified battery for especially this segment,” adds Goethe.

“So this is one goal for 2021 to establish Torqeedo as a supplier for this passenger transport and workboat segments.”

Talking about goals and “the next big thing” in the boat market, that stirred a few smiles in the round, the product developer wants to see a “mind-shift at the OEMs” to see electric as an opportunity to build different boats and not just to replace the diesel engine. He describes new value propositions for such dedicated electric ships, like “enjoying the silence, having a house load supply from the battery bank, or using space differently when getting rid of the motor compartment or tank and maybe back up generators to get a cool electric boat design and big mass volume production.”

Should it come to this significant volume, it poses the question of charging infrastructure. For the smaller boats, marinas provide anyway, Goethe replies before adding that small fleets could be “supplied from the already existing in the bigger harbours”. The management finds this valid in particular for overnight charging, a segment Torqeedo concentrates on currently.

Yet, with the market progressing, “the challenge begins when you electrify the entire fleet of 20 tourist boats, for example,” adds Goethe. While the manager points out that Torqeedo had already taken up the conversation with cities like Amsterdam in these cases, he also stresses a similarity to the rest of segment: “It’s the same discussions as with the mobility on the roads, who is covering the customer infrastructure and who is building out the charging infrastructure, what components should be on board, which should be onshore, because obviously if you have a bigger fleet, the DC charging is getting more and more interesting.” So here’s to the next challenge.

Virtual interview by Nora Manthey & company information.

0 Comments