Four manufacturers already met EU CO2 targets by Q3

Based on their sales figures for the first half of 2020, the PSA Group, Volvo, FCA and the BMW Group already meet the EU targets for average CO2 emissions from new cars, as shown by an analysis by Transport & Environment.

Renault, Nissan, the Toyota Mazda fleet and Ford only have to catch up with two grams of CO2 per km, while the gap is wider for Volkswagen (5g), Hyundai-Kia (7g-3g), Daimler (9g) and Jaguar Land Rover (13g).

To still reach the targets for the full year, PHEV and BEV are the much greater lever than more economical combustion engines. As T&E calculates, Renault’s sales of the Zoe alone will save around 15 grams of CO2 in the fleet average in 2020, thus ensuring compliance with the limits. Although Renault is still slightly above the limit for the first half of the year, the surge in demand triggered by the innovation premium should ensure sufficient e-sales at Renault in the second half of the year to meet the target.

Other manufacturers, such as Daimler, should not rely on the innovation premium alone, however. According to T&E, “Daimler expects to make up much of the gap by selling more plug-in hybrids of the E-Class, C-Class, A-Class and GLC-Class, sales of which have risen sharply this year”. The extremely favourable leasing offers for the Smart EQ and the limited special model of the A 250 e, both of which have led to an interim halt in sales, could be a harbinger of further discount campaigns for the other models if Daimler fails to achieve its target value in its internal projections – or possible CO2 penalties are offset (despite the damage to its image) against the costs of the discount campaigns.

VW is working on several fronts against possible CO2 penalties. As was announced at the end of September, Volkswagen is joining forces with SAIC and Ford to form a CO2 pool. So-called CO2 pooling is a controversial method of avoiding fines given the increasingly strict CO2 fleet value stipulated by the EU. The CO2 pool already formed by FCA and Tesla is the best example of this practice: without Tesla’s electric cars, Fiat Chrysler would not be among the top companies in T&E evaluation. On the other hand, Volkswagen is now pushing the first ID.3 vehicles onto the market, with the first ID.4s scheduled for delivery before the end of 2020. And in the case of plug-in hybrids, the first leasing campaigns are currently underway; a brand new Golf 8 eHybrid is available in commercial leasing from 99 euros per month.

The impact of the model policy is demonstrated by the front-runner PSA and the tail light Jaguar Land Rover. With its two platforms CMP and EMP2, PSA is currently bringing many plug-in hybrids and battery-electric cars to the market – from all-electric small cars to electric SUVs or mid-range SUVs with four-wheel drive plug-in hybrids. In contrast, the British carmaker, which is part of the Tata Group, currently has only one BEV in its range, the Jaguar I-Pace, and Range Rover has few plug-in hybrids. More attractive PHEV offshoots with larger batteries and CCS rapid charging will not be on the market until early 2021. The next BEV model, the successor to the Jaguar XJ, will again not be a volume model with a five-meter luxury sedan. There is no short-term remedy in sight at JLR – except with a CO2 pool.

Besides, JLR (as well as Daimler) is experiencing a trend that T&E describes as “worrying”: The proportion of SUVs rose to 39 per cent in the first half of the year. But T&E also takes a critical view of the increasing proportion of plug-in hybrids – with reference to the ICCT study on real vehicle consumption. The organization is therefore calling for the EU to set “2035 at the latest as the end date for the sale of internal combustion engines”, “including the current PHEV technology”.

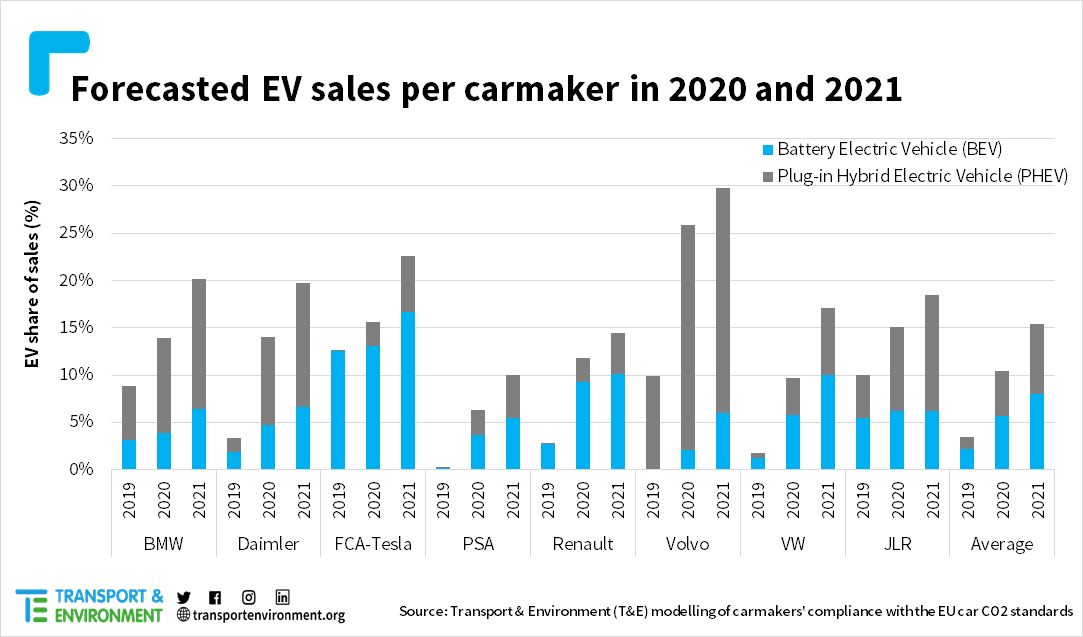

“Next year, one in every seven cars sold in Europe will be a plug-in,” says Julia Poliscanova, senior director for clean vehicles at T&E. “EU manufacturers are back in the EV race, but without more ambitious CO2 targets in 2025 and 2030 to spur them on, they’ll run out of steam as soon as 2022”. As Volkswagen’s Zwickau plant shows, e-mobility could also attract investments worth billions and create jobs.

In addition to the dubious climate benefits of plug-in hybrids, T&E sees another problem: the “lax” targets for 2025 and 2030 could lead to “decades of stagnation in EV sales” and stall the momentum after 2021. T&E, therefore, reiterates its call for a clear end date. “The electric car is finally entering the mainstream in Europe, but SUV sales are still growing like weeds. The only way to kill off highly-polluting vehicles is to give carmakers a clear end date now,” Poliscanova added; “Cars that run on biofuels, fake electric engines or fossil gas emit CO2 and shouldn’t be allowed on the market after 2035.”

With reporting by Sebastian Schaal, Germany.

0 Comments